Exciting news for digitally-minded American fast-food fans! Shake Shack, the growing US burger chain, has opened its first-ever cashless, kiosk-only location in New York. (1)

Shake Shack’s CEO Randy Garutti describes the new store concept as a “playground” and it features a variety of new digital elements to try and make the dining experience more seamless.

There won’t be a counter; instead customers order and pay at kiosks, or through their phones. They receive text notifications when their food is ready so they don’t have to wait in line. And cash is most definitely not welcome.

Garutti says the move will allow the kitchen staff to focus on the food, and the front of house staff to focus on the customer. “It’s really a guest-centric strategy” he said. “It’s not just about the hamburgers.”

By delegating the straightforward, transactional elements of the dining experience to technology, this should in theory leave staff with increased capacity to make the whole experience better, offering a value-added, more personalised dining experience… which in turn should create goodwill amongst customers.

Will it work like that? Or will staff spend their time fighting tech glitches instead of helping customers? Time will tell!

Cashless kiosks are new for Shake Shack, but on the other side of the Atlantic there’s another high street food chain which opened their first cashless restaurant a year earlier, in 2016. (2)

And once they’d opened their first one, London-based healthy food chain Tossed decided to roll out their self-service kiosks to the bulk of their 17 stores.

And once they’d opened their first one, London-based healthy food chain Tossed decided to roll out their self-service kiosks to the bulk of their 17 stores.

Vincent McKevitt, founder of Tossed, hopes that the move will help improve efficiency for customers. “Most operators face speed and capacity issues at lunchtime,” he says. “This unique point-of-sale solution allows our team to focus their energy on our speed of production.”

It’s another example of companies choosing to assign basic transactional work to technology, in order to free up staff to utilise their skills in improving the customer experience.

But it’s not just corporately-owned high street retailers that are moving away from handling cash. Smaller, independent retailers are following suit in droves.

For instance Browns of Brockley, a neighbourhood coffee shop in south London, had a nice interview in their local paper in early 2017. (3) The angle was that they were the latest local business to go card only, as “more turn their back on the ‘faff’ of taking coins and notes”.

The owner, Ross Brown, told the reporter that he switched to cashless after a trip to Sweden, where he “hardly used cash at all and didn’t even notice”.

So could the UK end up going cash free?

- Cashless payments overtook the use of notes and coins for the first time in 2015 (4)

- 75% of the value spent at UK retailers was on a debit or credit card in 2016, up 10% since 2009 (5)

- Over 1.1 million outlets now accept cards, up 4.2% since 2013 (6)

However, for every Ross Brown here in the UK, there are many more Swedes in Sweden who are helping their country to potentially become the world’s first truly cashless society.

A study by Stockholm’s KTH Royal Institute of Technology has predicted cash could be history there by 2030. (7)

Looking at the numbers, it seems plausible… Out of 1,600 bank branches in Sweden, 900 of them no longer store cash and will no longer accept cash deposits. (8) And the value of Swedish krona in circulation has plummeted from 106 billion in 2009 to 60 billion in 2016 – that’s a drop of more than 40% in seven years. (9)

Visa reports that the Swedish public use payment cards three times more often than the average European.

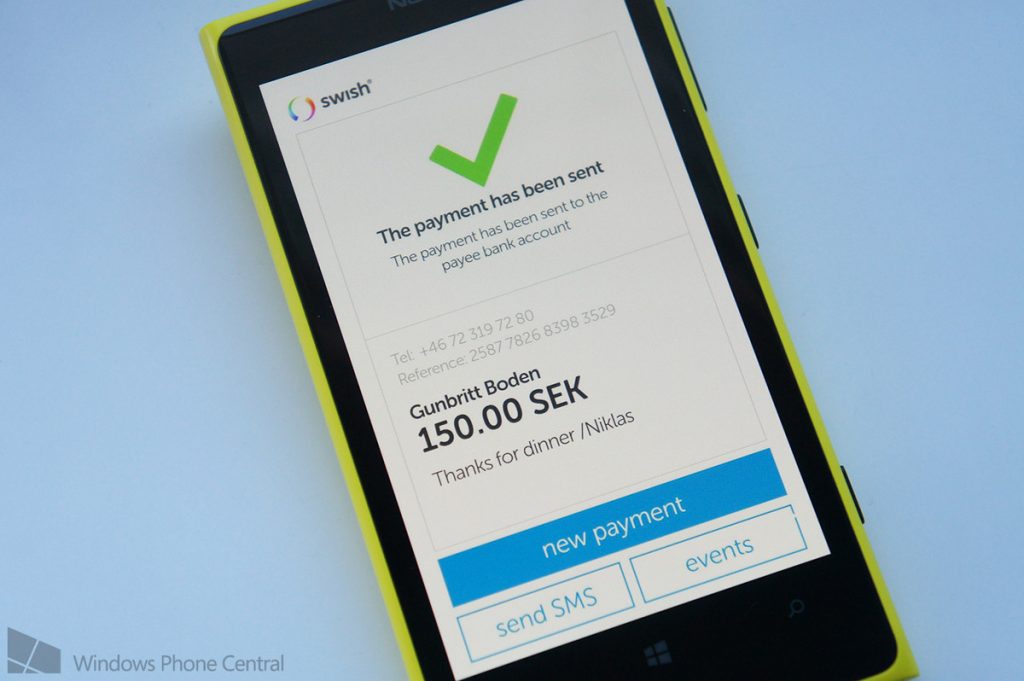

Whilst card transactions in Sweden are commonplace, there’s a surge towards using phones, not cash, to transfer cash between people. When Swedes give each other money, they are more likely to “Swish” than hand over notes. To the uninitiated, Swish is a spectacularly successful app which uses phone numbers to transfer money between bank accounts in real time, and is used by over half the population; more than five million people in Sweden alone. (10)

Whilst card transactions in Sweden are commonplace, there’s a surge towards using phones, not cash, to transfer cash between people. When Swedes give each other money, they are more likely to “Swish” than hand over notes. To the uninitiated, Swish is a spectacularly successful app which uses phone numbers to transfer money between bank accounts in real time, and is used by over half the population; more than five million people in Sweden alone. (10)

So it appears that Swedes are increasingly seeing good old-fashioned notes and coins as unnecessary. But is this general shift away from cash a good thing?

Generally speaking, it appears to be positive for retailers. Yes, it’s true that cashless kiosks and mobile transactions will inevitably be subject to transaction fees, hackers, and the vagaries of tech crashes and wifi catastrophes.

On the positive side, however, not having to physically manage cash is more convenient and frees up capacity for staff to spend more time acting as humans and giving personalised , thoughtful customer service, rather than spending their shifts performing tasks which technology can do better.

Plus, of course, cash is anonymous and doesn’t offer all the profitable opportunities of harvestable personal data which allows retailers to start connecting with, and learning from, customers.

For certain consumers, however, the benefits of the move away from cash are less clear-cut. Certainly for many people, for the e-savvy consumers with smartphones and bank accounts, it’s much more convenient and more secure – a stolen card can be cancelled and replaced in a way that stolen cash cannot.

However for the UK’s 1.5million unbanked people, the 25 million in Europe and the 68million in the US, this revolution instantly, resolutely, leaves them behind. They have to deal in cash – as do many in the gig industry, and the millions of cleaners, babysitters, handymen, gardeners and couriers who are still paid – or tipped – in coins and notes.

It would also leave behind older generations – who are typically not used to e-transactions – and younger generations – who do not have access to banking services yet.

In the UK we’ve seen big and small retailers switching to cashless for, they say, the sake of customer convenience. However this means they are inevitably excluding some significant demographic groups.

So what will happen? Are UK retailers going to press ahead with cashless technologies, at the risk of excluding certain groups? Or will they be forced to compromise and continue accepting cash? Either way, it will be interesting to watch.

Bryony Graham

Further Reading

1 Shake Shack’s Cashless Kiosks, New York

2 Tossed’s First Cashless Restaurant, London

3 Browns of Brockley’s Interview

4 http://www.bbc.co.uk/news/business-32778196

5 and 6 http://www.theukcardsassociation.org.uk/news/UKCardPayments2015news.asp

7 Stockholm’s KTH Royal Institute of Technology

9 Value of Swedish kronas in circulation

10 Swish